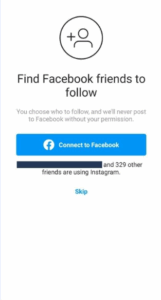

Instagram (social): Optimizes for immediate value—seeing friends. The flow pushes account creation: a quick profile (name, email, passwords, username) is all it’s needed. Alternatively, users can also log in with Facebook in one click. Then, there is the skippable page of Find friends/contacts, so friction is low and value arrives fast (feed, stories).

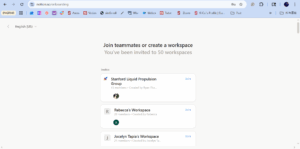

Notion (productivity): The set up for notion also values immediate value. Onboarding can be done through linking a Google account. After giving permission for email and name, then you will arrive at the Notion home page, where you can join or create workspace.

In terms of creating workspace, it again prioritizes immediate value and setup clarity. It gathers just enough to tailor the first canvas by first asking users to choose whether it’s 1) for personal or work use 2) on your own or with other people. Then, there are two opt-in functionality to combine with calendar or download app in desktop. These questions help users on board as quickly as possible. Afterwards, the workspace is created with detailed instructions for reference.

Venmo (finance): Prioritizes value creation and compliance. Similarly, the onboarding for Venmo starts with a question of three choices about uses (personal, team, business). Afterward, the system requires baisc information to verify identity, which includes your phone number. After this, you will be able to receive money which prioritzes usability given the least amount of information. Nevertheless, real payment requires bank linking/verification. That step is high friction but mandatory for value (moving money). Financial services see large abandonment during KYC/account linking, so UX must over-explain, reassure, and offer fallback paths.

Friction Cost:

Instagram— The friction cost is generally low because most steps can be skipped except of email and name. If Instagram asks to “find friends” before you see why the app is useful, about 5% of people may quit right there. That’s roughly 5,000 out of 100,000 new users. Cost ≈ 5,000 lost activations; deferring to a triggered moment can recapture most of this. Nevertheless, this will most likely not be the main target audience as the network effect creates user stickiness.

Venmo—Benchmarks show high abandonment in financial onboarding; some studies report ~60–68% drop-off during application/verification. If we attribute even 40% loss at the bank-link step, cost ≈ 40,000 users who install but never transact. Nevertheless, if the users come in being certain about their need for the app, then they most likely will finish onboarding, as it is very obvious and reasonable for bank account to be tied in order to have a transaction.