Cross-company comparison of freemium conversion strategies

Spotify (premium conversion)

Spotify makes its free-to-paid path clear by keeping friction to the listening experience – ads, no offline mode, and limited payback control – while still providing signature personalization features (daily mixes, AI recommendations, Wrapped), full catalog access, and social experiences (friend activity, collaborative playlists). By limiting friction to minor inconveniences (ads and skips) rather than core features, Spotify makes upgrading the natural solution rather than churning to competitors and leaving established listening profiles, maximizing LTV through early conversions. LTV is further strengthened by Spotify’s social ecosystem and its tiered plans (student, individual, duo, family, kids), which extend customer lifespan and encourage group adoption.

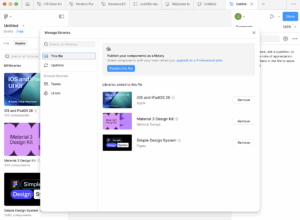

Figma (team expansion)

Figma’s upgrades are decisive and require team adoption, so unlike Spotify’s recurring low-level friction in the listening experience, Figma must delay friction until it can prove value to an individual user to access their team. Figma’s free plan restricts team workflow features (unlimited files, team design libraries, centralized assets) while giving individual designers and small teams a frictionless design experience powerful enough to operate, fueling word-of-mouth adoption with each share. As teams expand and collaboration becomes essential, they naturally upgrade and assign paid seats, converting entire teams at once and driving high LTV. Since Figma’s payment plans match organization maturity rather than usage amounts, role-based seats (Collab, Dev, Full) and admin/security features create clear, predictable upgrade stages that teams will typically meet as a sign of growth. By delaying friction to funnel power-users and growing teams first, Figma’s wager on a free experience brought high retention and organic conversion.

NYTimes (subscriber value)

Unlike Spotify and Figma where consistent usage naturally leads to conversion, the Times’ must balance friction for two different user groups – power users (routine readers who are willing to pay) and casual users (visits once in a while, prompted by some event), with most falling under the latter category where a paywall could lead to immediate churn. So, the Times’ conversion strategy must optimize for engagement first to acquire casual users. Its dynamic metered paywall adjusts the free-article limit based on each visitor’s behavior, triggering a paywall only after certain repeated visits. In addition, an “All-Access” bundling option offering all Times’ products at a discounted and lower cost than individual product subscriptions drives LTV by acquiring casual users who formed habits in other verticals (ie. Games or Cooking) into the broader ecosystem, deepening engagement and increasing the odds of long-term retention.