How We Selected Our Riskiest Assumptions

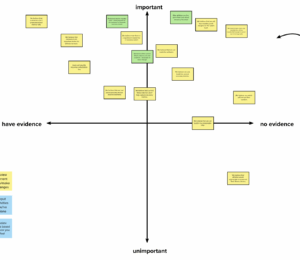

First, we mapped out all of our assumptions for our current FitPulse design, pricing model, and overall plan. When we mapped out all of FitPulse’s assumptions, we asked two questions:

- How important is this to our success?

- How much evidence do we actually have to back it up?

The riskiest assumptions are the ones that are both highly important and weakly supported by evidence. We looked for statements that were:

- Highly important to FitPulse’s success: assumptions that could make or break the business model.

- Highly uncertain: areas where we lacked data or direct validation from users.

From that lens, we applied a few guiding principles:

- Prioritize pricing and financial assumptions.

Pricing directly determines FitPulse’s viability and growth potential. We flagged any assumption tied to willingness to pay, conversion, or revenue structure as high priority to test. - Focus on what drives adoption, i.e. wearability and appeal.

Since FitPulse depends on continuous tracking, we saw the aesthetic desirability of the device as a core behavioral risk. If people don’t want to wear it, even great data won’t matter. - De-emphasize what we already know.

For example, “Customers don’t understand their metrics” is important but not risky, and we already have evidence this is true. Our goal was to focus on what’s still uncertain, not what’s already validated. - Highlight audience alignment as both strategic and risky.

The assumption that “Elite athletes are the users that care about recovery the most” is critical because it defines our target market. Choosing to design and market around this group shapes everything, such as pricing, product features, brand tone, and go-to-market. If we’re wrong about this core audience, the entire strategy shifts.

These criteria helped us narrow down to three green assumptions highlighted in green on our map: pricing model viability, recovery priority, and hardware desirability, as the ones that most determine whether FitPulse can scale successfully.

What We Narrowed in On

1. “The monthly cost + initial payment for the hardware is a feasible business model.”

This assumption is critical as it determines if FitPulse can sustain itself as a business. Even if the product solves a real problem and resonates with users, the wrong pricing model could completely block adoption. People are used to either paying once for hardware (like Apple) or paying monthly (like Whoop), but not both. Testing this assumption helps us learn whether our pricing feels justified and competitive in a crowded market. Without validating that users are willing to pay this way, any other product improvements would be irrelevant, since growth relies on revenue.

2. “Elite athletes are the users that care about recovery the most.”

This assumption is critical because our current product strategy focuses on elite and highly active athletes as our primary users. If this group is not actually more interested in and willing to pay for a dedicated recovery device, then our core target market and messaging would be misaligned. That would require us to shift our positioning and rethink who we are building for. Our team discussed this together and agreed that validating our target user segment is essential at this stage as this assumption defines who FitPulse serves best. We want to ensure that they are willing to invest in tools that give them a measurable edge and better understanding and that they will truly derive value from this.

3. “Current fitness devices are not aesthetic or desirable enough to wear.” –> “We believe that our hardware is more desirable + aesthetic to wear for elite athletes than competing recovery products.”

Our assumption is critical because the longer our device is worn, the more data we can collect and thus the more reliable and precise our metrics and actionable insights will be. Aesthetic appeal is a huge factor that determines how regularly users wear our product. Additionally, we assume having the most desirable hardware will give us an edge over other recovery products and justify premium pricing; thus, we will allocate a large amount of resources towards it. The team discussion revealed that the success of our next series B model is heavily dependent on prioritizing visual appeal.

In short, these assumptions are risky, but they define whether FitPulse can move from a niche recovery tool to a mainstream wellness brand.