Introduction

For our comparative research, we looked at apps and tools that helped people manage their shopping habits. We looked at a diverse range of apps, which had functions ranging from shopping helpers to budgeting to closet planning.

Rocket Money (found by Casey Nguyen):

Summary: Rocket Money is a personal finance app that helps users refine their financial strategies through a range of useful features. These features include budgeting, automated savings, proactive bill negotiations and subscription management. The app offers both free and premium services to cater to diverse financial management needs.

Strengths: One notable benefit of Rocket Money is its ability to automatically cancel subscriptions and negotiate bills on behalf of users, resulting in savings. The premium version enhances user experience by offering budget creation, credit reports and real time net worth assessments.

Weaknesses: However it’s important to note that the subscription fee for premium services may not be affordable or accessible for everyone. Additionally, some individuals might have concerns about sharing information due to privacy considerations.

Value Proposition: Despite these drawbacks, Rocket Money stands out by adopting a user approach with its pricing model; users can pay what they deem fair for the advanced services provided. This “pay what you think is fair” value proposition makes it a versatile tool for improving financial well being.Interesting features: Some notable features offered by Rocket Money are the Cancellation Concierge and bill negotiation services. These help people find ways to minimize their expenses. Additionally, real-time account syncing, account sharing functionality and priority customer support through premium chat contribute to an enhanced user experience for those who prioritize comprehensive financial management and collaborative planning.

Rakuten (found by Casey Nguyen):

Summary: Rakuten provides a savvy shopping experience by offering Cash Back coupons and great deals, at over 3,500 well-known stores. When shoppers use Rakuten’s app, browser extension or website to make their purchases they earn Cash Back on their transactions. This Cash Back is then paid out every three months through check or PayPal. The best part is that Rakuten’s partnerships with stores ensure that the savings they get from customer referrals are passed on to shoppers in the form of Cash Back.

Strengths: One of the biggest pros about Rakuten is that it offers Cash Back from a range of stores and gives users additional savings through coupons.. They have a user-friendly app and browser extension.

Weaknesses: However there are a couple of downsides to consider. Users need to remember to shop through Rakuten if they want to receive Cash Back, which might be inconvenient for some people. Additionally the rewards are distributed quarterly so if users are looking for immediate savings it may not be ideal.

Value Proposition: Rakuten presents itself as a value platform that turns shopping into an experience by giving back a portion of every purchase as Cash Back. With its use features and abundance of deals Rakuten has become a go to platform for budget consumers.

Interesting Features: Rakuten stands out for its app, which allows users to shop anytime and anywhere. Additionally, they offer a browser extension that automatically searches for and applies coupons, making the shopping experience more enjoyable. Another great feature is their referral program, which adds to the sense of community and enhances the savings experience, for everyone involved.

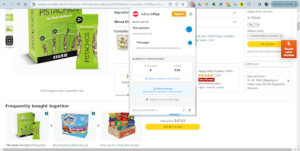

Honey (found by Shina Penaranda):

Solution: Honey is a free browser extension geared toward helping online shoppers take advantage of deals they may not have known about.

Problem: It solves the problem of online shoppers who feel that they are missing out on savings or deals but don’t want to spend much time searching for the lowest price or discounts for each and every item.

Strengths: The extension is easy to use since it integrates with the browser to detect when the user is looking at a product and lets the user know whether there have been recent pricing changes, that they have eligible coupons, or if there is another listing for the same item at a lower price, all directly on the product listing page the user is currently on. The user can even save the item in Honey and have it notify them when the price drops.

Value Proposition: All of these features contribute to a tool that offers the value of having an “expert” save an online shopper money on purchases in real time.

Weakness: The downside to this extension is that it still encourages users to purchase items that have been discounted by offering them rewards for purchases made while signed into Honey and “celebrating” that the user has taken advantage of some deal toward which Honey has helped guide them. Honey encourages these purchases because it generates revenue from partnered stores for each purchase customers make using Honey.

Interesting Points: For this reason, those who are trying to cut down on impulse purchases may not reach their goal with Honey; on the other hand, those who want to purchase items at the lowest price will likely find value in the extension.

Adblock Plus (found by Shina Penaranda):

Solution: Adblock Plus is a free browser extension that hides unwanted web elements, such as advertisements, from users who do not wish to see them.

Problem: It solves the problem of people who go online and become frustrated or distracted by all the advertisements they see on webpages.

Strengths: The upsides to this extension are that it works passively (i.e., after installation, the user does not need to think about activating it for each page accessed or manually block ads the vast majority of the time) and it can easily be turned on and off as needed.

Value Proposition: The value that Adblock Plus offers users is the peace and luxury of accessing different webpages without needing to see, click out of, ignore, be annoyed by, or even think about advertising web elements or popups.

Weaknesses: The downside to the extension is that it is not perfect: some advertisements may still slip through, while desired popups or redirects may be blocked and require the user’s manual approval to access them.

Interesting Points: The extension works so subtly that a user may forget that it is there; it is only when they see advertisements again that they distinctly feel the absence of their adblocker.

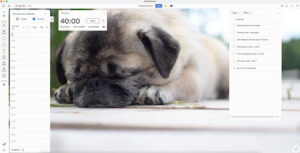

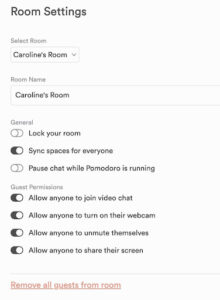

LifeAt (found by Caroline Tran):

Summary: LifeAt is a space for students, teams, and work groups to organize life and work with features like importing calendars, pomodoro timers, task lists, planners, and even a focus mode.

Strengths: The platform has multi-use functionality and allows the users to tailor the space to their needs. It also has pre-set features for the focus space like a visible timer and prepared backdrops and white-noise. This offloads the work from the user and encourages them to use the space even more.

Weaknesses: Its multifunctionality is also a weakness – it gets overwhelming and hard to manage if too many features are added onto the screen. It also requires a subscription in order to invite peers or work teams to share in the space. Lastly, although it creates a fun focus backdrop, it does not prevent or discourage the user from distractions like opening a shopping tab or scrolling on their phone.

Value Proposition: Keeping productivity tools all in one place and allowing this space to be opened to communities of peers and teams.

Interesting Features: The focus mode is a way for users to create a “room” with focus spaces and scenes like sleeping pets, raining outdoors, or a fireplace. LifeAt has a unique setting that allows users to invite guests (perhaps group members or peers) to join their focus mode rooms – creating an accountability and encouraging community that thrives on collective growth. It also allows users to import Spotify functionality to reduce switching between multiple apps.

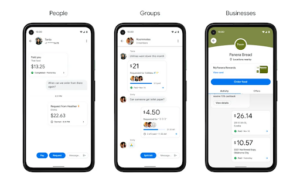

Google Pay (found by Caroline Tran):

Summary: Google pay supports money transfer and online payment like many other applications. However, its seamless connection to gmail and interesting goal-setting features keep it unique from its competitors.

Strengths: The application can be used in most cellular devices and allows for convenient online payments. Its use of blue and green colors also make the finance management experience less intimidating which encourages money saving and tracking. The app also automatically highlights trends in spending so that responsibility is offloaded from the user.

Weaknesses: It’s not accepted everywhere for tap payments or transfers, and also makes it difficult for users who aren’t already reliant on Google’s many tools. Its primary use is to make payments or transfer money – not goal-keeping. This makes it quite similar to its competitor, Apple Pay.

Value Proposition: It saves information based on gmail accounts and delivers transparency which create seamless access to payment and spending history as well as categorized trends without depending too much on user input.

Interesting Features: The user is able to set budgeting goals which are purposefully celebrated in incremental steps. Not only does this encourage the user to budget more, but it also encourages the user to spend more time thinking about the budget throughout their spending instances.

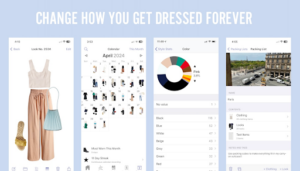

Stylebook (found by Angela Mao):

Summary: Stylebook is an expert wardrobe organization and closet management tool that allows the user to import their actual clothes, create new outfits, plan what to wear, and manage their wardrobe.

Strengths: One of Stylebook’s perks is that the user gets to see all the items they own in one place, allowing them to see how many items they already have, which discourages irresponsible shopping behavior. Stylebook also uses statistics to show users the value of their outfits with their cost-per-wear metric, and gamifies the user’s closet to encourage rewearing and restyling outfits.

Weaknesses: One weakness of Stylebook is that the set-up process is tedious. To actually get your clothes into Stylebook, you need to upload photos of each clothing item you wear or add images directly from the web. This can discourage users from adopting Stylebook despite its perks because they may think it is too much work.

Value Proposition: Stylebook’s main value proposition is that it discourages excessive shopping behavior by showing the user 1) the number of clothing items they already own 2) they can make complete outfits with what they already own and 3) the value they got out of clothing items they already own.

Interesting features: Stylebook emphasizes that they have 90+ features for users. Some of the features that stood out include outfit shuffle (to find items you haven’t worn in a while), style statistics (what you wear the most, the least, etc), and outfit layouts.

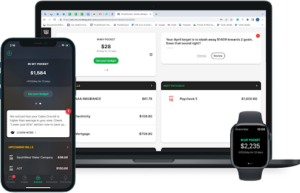

PocketGuard (found by Angela Mao):

Summary: PocketGuard is a budgeting app that has simplified budgeting tools to help set daily spending limits. All of a user’s bank accounts, credit cards, loans, and investments are linked to the app so that the user can receive a personalized report about their spending behavior.

Strengths: One of PocketGuard’s strengths is that they have a bill tracking feature that lets the user set up specific reminders about their spending. It is also really easy to use, since the app is big on simplifying and does a lot of work for you.

Weaknesses: One trade off with PocketGuard being so easy-to-use is that its catalog of features is not as robust as other budgeting apps. Additionally, there is a paywall behind PocketGuard Pro, which has a bunch of additional features.

Value Proposition: PocketGuard’s value proposition lies in that it will clearly show the user their spending behavior and highlights how they could improve/budget better.

Interesting features: Some additional features that PocketGuard has are bill negotiation, recommendations, pie charts, and custom budgets.

Comparative Matrix

After finding all of the companies for our comparative research, we created this comparative matrix. We felt like our tools/apps were either used to manage financial decisions or to shop more effectively, and relied on either guided decision-making (such as offering suggestions for budgets) or user autonomy (user is given information that they can then make decisions on).